The Hidden Costs of Upsizing or Downsizing Your Home in Winnipeg

The Hidden Costs of Upsizing or Downsizing Your Home in Winnipeg

If you're thinking about buying a bigger or smaller home in Winnipeg, it's important to know about the extra costs that come with that decision. Beyond just the price of the house, there are other fees and taxes that can add up. Knowing these can help you plan better and avoid surprises.

Understanding Property Taxes

Property taxes are a yearly fee you pay to the city based on your home's value. When you buy a larger or smaller home, these taxes can change too. If your new home is more expensive, you will likely pay higher property taxes. These taxes fund local services like schools, parks, and road maintenance, making them essential for the community. Before buying, check the property tax costs in different neighbourhoods to understand the financial commitment.

Land Transfer Tax: A One-Time Fee

When you buy a home in Winnipeg, you need to pay a land transfer tax. This is a one-time fee calculated based on the price of the home. The more expensive the home, the higher the tax. The idea is to transfer ownership officially from the seller to you. Make sure to include this in your budget because it’s a cost everyone has to pay when purchasing property in Manitoba.

Calculation Example:

- For a home costing $300,000, you might expect to pay around $3,720 as a land transfer tax in Winnipeg. This amount will vary based on the price of the home, so it’s wise to consult with a real estate expert or use an online calculator to get an accurate estimate based on your specific situation.

Mortgage Insurance Costs

If you're buying with less than a 20% down payment, you'll need to pay for mortgage insurance. This protects the lender in case you can't pay back the loan. The premium will depend on how much you're borrowing and how much you’ve put down. Be sure to factor this into your overall budget, as it can affect your monthly mortgage payment.

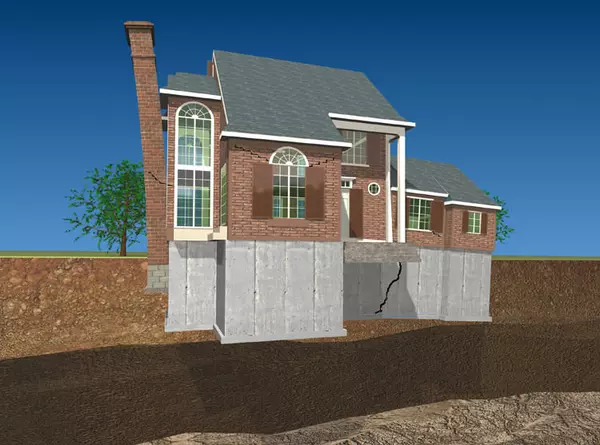

Home Inspection Fees: Ensuring a Safe Purchase

Before finalizing the purchase, it is advisable to get a home inspection. This will help identify any potential problems with the house, such as a leaky roof or electrical issues. Though it’s an additional upfront cost, a thorough inspection could save you from costly repairs down the road. Budget around $400 to $600 for this service.

Moving Costs: More Than Just the Truck

Moving involves more than just trucks and boxes. There are packing supplies, potential storage fees, and possibly hiring professional movers to consider. These costs can easily add up, especially if you're relocating from a larger home or a distant location. To keep these expenses in check, plan your move ahead of time, compare moving service prices, and only move the items you truly need and use.

Utility Connection and Service Fees

When moving to a new home, you'll need to set up utilities like water, electricity, gas, and internet. Often, this means paying connection fees to re-establish these services in your new residence. The costs for these can vary, but it is good to set aside a few hundred dollars to ensure these services are ready when you move in.

Renovation and Decoration: Customizing Your New Home

Whether upsizing or downsizing, you may find some spaces need alterations to fit your lifestyle. Renovations can range from simple painting to major kitchen redesigns. It’s a good idea to have a budget for any changes or updates you might want to make, including furnishings to fit a larger or smaller space.

Legal Fees and Closing Costs

Legal fees are another important consideration, as buying a home involves significant legal paperwork. The legal fees ensure that your purchase is legitimate and your rights are protected. Closing costs may also include items such as title insurance and deed recording. Expect to budget approximately 1.5% to 4% of the home’s purchase price for these expenses. It’s helpful to consult with a real estate lawyer to understand what this will specifically mean for your purchase.

Professional Real Estate Services

Partnering with a knowledgeable real estate agent can streamline the home-buying process, providing valuable expertise and negotiation skills. They are vital in ensuring you are aware of all the fees, taxes, and hidden costs involved in the transaction. Their commission is typically a percentage of the home's sale price, which is already factored into the listing. However, understanding their role and ensuring alignment with your goals is crucial.

Budgeting Tips for Success

List All Costs*: Write out all anticipated costs, including the ones we discussed here.

Emergency Fund*: Have a reserve fund for unexpected expenses like urgent repairs.

Professional Advice*: Work closely with a financial advisor and real estate agent to know exactly what you can afford.

Review Regular Expenses*: Check your regular expenses - these will help you cover monthly costs post-purchase, like utilities and maintenance.

Making an informed decision requires understanding these extra costs when buying a new home in Winnipeg. By preparing for these expenses, you can enjoy your new space without financial stress.

Categories

Recent Posts